ESOPs (“Employees Stock Options Plans”) is the generic term for incentive schemes provided to the employees of a company. It is defined as a right granted to an employee to apply for shares of the company at a pre-determined price.

Accounting Treatment:

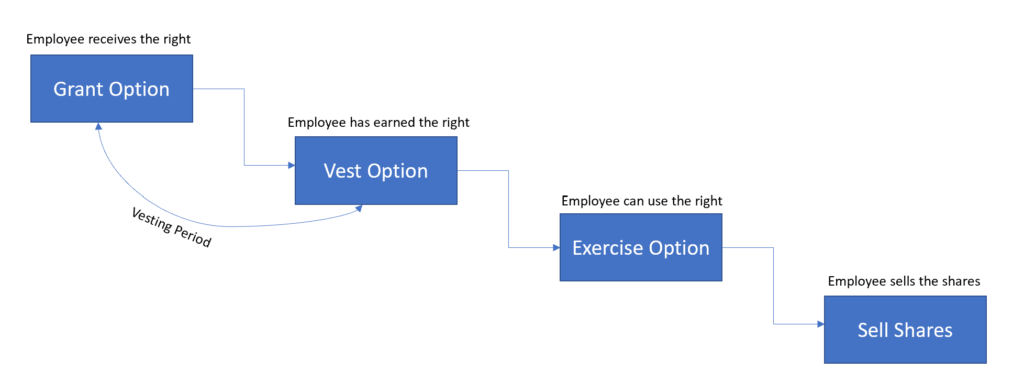

An option is first granted to an employee and after a specific period this option vests with the employee. The period between granting the option and vesting is known as the vesting period.

At the time of granting, the company should recognize an amount in the financial statements based on the best available estimate of number of shares that they expect to vest at the end of the period. These estimates should be reviewed regularly and revised in the financial statements if necessary.

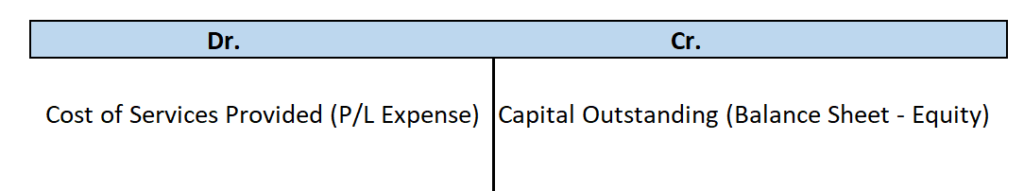

The cost in the financial statements reflects the ‘cost of the services’ provided by the employee. A corresponding capital balance has to be recognized in equity as ‘outstanding stock options’. The double entry of the transaction will be a debit in the profit and loss statement and a credit in the equity section of the balance sheet.

To determine the appropriate cost to be included in the financial statements the most common method used is the fair value method. When calculating the fair value of an option, a variety of factors should be considered such as:

- The price at which the option will be exercised

- The duration of the option

- The current price of the company’s shares

- The volatility of the company’s shares

- The future expected dividends of a company

- The current risk-free interest rate which is the yield currently available on zero coupon government securities or bonds.

The annual calculation will be as follows:

(Fair Value of Option * Total Employees * Total Options Issued * Expected Number of Options to be Vested) / Vesting Period

Any adjustment calculated based on the changes in the formula above will be included in the financial statements as an adjustment to the cost recognized in the profit and loss in the period and the equity account in the balance sheet.

If you need further help with accounting for ESOP’s, we would love to have a chat and see where Balance Consulting can help you. Get in touch at info@balanceconsults.com.